December 31, 2004

Foreign Inflows in the Bond Market

By Bob

Brad Stetser had an interesting post that China had started buying mortage back securities. There are some interesting comments following the post, namely one person said that this probably makes a revaluation of the currency less likely since it lengthens the duration of its portfolio.

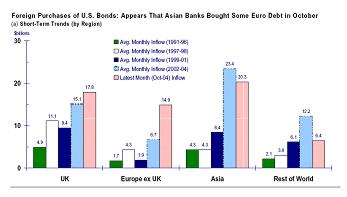

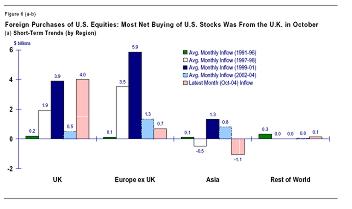

This reminded me of a chart I saw the other day about foreign inflows into the U.S. The charts come courtesy of B of A Securities' Thomas McManus in a report titled Holiday Shopping(the PDF is behind a firewall). It would appear that that Europe with the exception of the U.K. continues to shun U.S. equity markets, however they seem to find our bond market attractive. So, the falling Dollar vs. the Euro has at least worked part of its magic. Also, anectdotally, I've been told that Europeans are very aggressive right now in the private equity markets. This wouldn't show up in foreign purchases of equities.

The pink spikes are only for October and don't constitute a trend by any means, but it'll be interesting if these numbers hold for the rest of the fourth quarter as the Dollar continued to fall. Interestingly, the U.K. had been heavily investing in the U.S. bond market for the last couple of years even though their interest rates have been higher.

So, while Asia seems to have cut back a little bit on U.S. bond purchases in October, Europe seems to have picked up the slack.

Posted at December 31, 2004 06:42 PM

TrackBack URL for this entry:

http://truckandbarter.com/mt/mt-tb.cgi/364